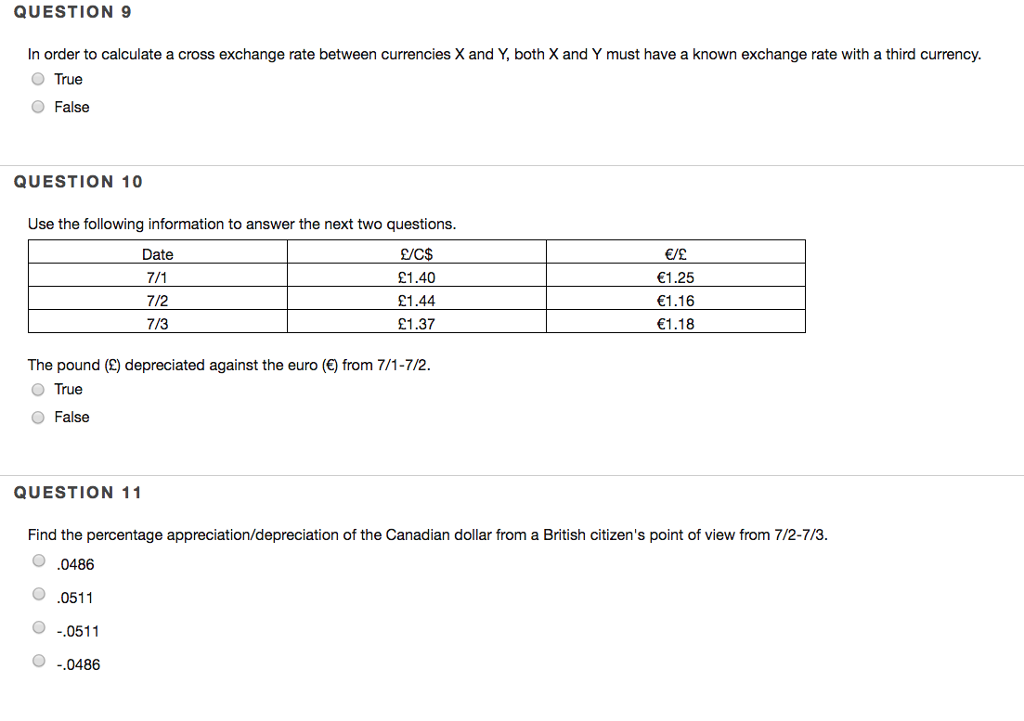

Cross Exchange Rate and Depreciation/Appreciation of Currencies.

However, if there is an appreciation due to speculation, then it could be harmful as exporters will not be able to compete.

The Swiss intervened to prevent the Swiss France becoming too strong in recent Euro crisis. See more detail on the effect of exchange rates on business. An exchange rate is determined by the supply and demand for the currency. If there was greater demand for Pound Sterling, it would cause the value to increase.

An appreciation in the exchange rate could occur if the UK has:. Factors influencing exchange rates.

This occurs when the government intervenes to try and keep the value of the currency at a certain level against other currencies. For example, in , the UK joined the Exchange Rate Mechanism where the value of Pound was supposed to keep within a certain target band against D-Mark. Exchange Rate Mechanism Crisis. Some countries are not part of an official exchange rate mechanism, but they may still to try influence their currency.

For example, China has sought to keep the value of their currency undervalued by buying US assets.

Currency Appreciation & Depreciation: Effects of Exchange Rate Changes

The motive for keeping exchange rate undervalued is that exports become more competitive leading to higher growth. The Euro is a bold attempt to replace individual currencies with a single currency.

The idea is to eliminate exchange rate fluctuations. However, the Euro has run into several problems.

In particular, uncompetitive countries are no longer able to devalue to restore competitiveness. I can not get my brain wrapped around this. Does that mean the Euro is closer to the USD or? I will be getting some Euros before we go to Ireland in May for pitstops, taxis, etc. The appreciation of the domestic currency raises the value of financial instruments denominated in that currency, while there is an adverse impact on debt instruments. From Wikipedia, the free encyclopedia. For the accounting term, see Depreciation.

Devaluation Revaluation Capital appreciation accounting and finance Exchange rate Marshall—Lerner condition. Retrieved from " https: Foreign exchange market Currency Inflation Monetary policy. Views Read Edit View history. Find out the former exchange rate of one currency against another.

You need to know the exchange rate that prevailed before the depreciation. To get an exchange rate for a particular day, a closing exchange rate at Identify the exchange rate after the depreciation. Make sure the exchange rate definition is the same as you used in getting the exchange rate before the depreciation.

Navigation menu

Take the exchange rate before and after the depreciation, subtract the smaller number from the greater, divide the result by the greater number, and multiply by Then we divide 0. This means that over the given period, the euro depreciated against the U. Find out how much a currency could buy at the point of time from which you want to calculate the change in the currency's value.