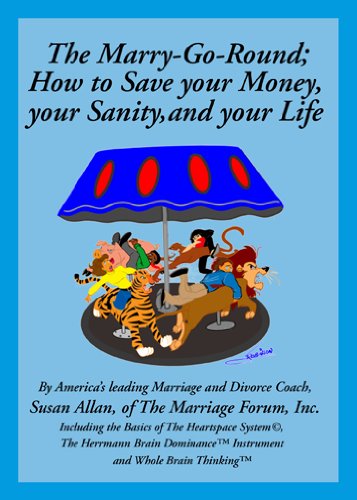

The Marry-Go-Round: or How to Save your Money, your Sanity & your life!

Contents:

I was completely and utterly satisfied. I gave the place more than I had, used up reserves that will never be replenished.

- Stories to Read or Tell from Fairy Tales and Folklore.

- In My Element: Inspiration for Empowerment!

- Lesson Plan Fever Pitch by Nick Hornby.

- 10 Ways to Simplify Your Budget and Keep Your Sanity.

- Larry Winget Quotes (Author of Shut Up, Stop Whining, and Get a Life)?

- Rebekah Armstronge!

It was all utter folly. Meanwhile, Sarah - who was seriously ill for nearly a year of that time - looked after the children and tried to run the business, continue designing jewellery collections and salvage something from the disastrous economic position.

I want to be alone: the rise and rise of solo living

Ironically, at this time I started to appear on TV. A researcher had seen one of the monthly pieces I was writing for You magazine and got me on one of the rare occasions when I ran in to answer the phone. Would I do a screen test?

I never considered it more than a curious turn-up for the books, but the money was vital. Of course, the shit hit the fan. The overdraft soared, interest rates doubled, the banks wanted their money and bounced every cheque. It is a familiar story, and it could have been worse. The business was voluntarily liquidated, the shop sold for a 10th of what it had cost, and television and journalistic work, caught in the depression, dried to a trickle.

At least we found a buyer for the house before the bank repossessed it. Sarah, having lost her job and business, drove down the drive on 15 February , her birthday, with three little children asking why Daddy was crying. I don't want to overegg the pudding. But for the record, the worst thing about losing your job and your home is not the loss of creature comforts but the humiliation.

You feel such a complete and utter fool. There was no work, so I was on the dole in My mother died and left me enough money for a deposit on a house, and we found our current house. It was obviously lovely, but without water, electricity, sanitation or any interior walls and, as it turned out, a roof that was about to slide off. It was declared unfit for human habitation, and we rented a rat-infested farmhouse nearby. These were the bad times. Things came to a head in spring , when a newspaper ran a picture of a wartime Serbian about to have his head sawn off by a gang of laughing Croatians.

This disturbed me beyond all measure. Couldn't close my eyes. Couldn't sleep in case I dreamt. I was doing a rare day's work with a film crew when I saw a cow charge into the dining room in slow motion. No one else noticed. I drove the children to school and saw a council worker cutting down the cow parsley, and I remember slumping over the wheel, sobbing like a baby.

My body began to collect infections in a casual, almost perfunctory way. I was 37 and I was over. Sarah, of course, came to the rescue. She told me that she could not cope with me any longer.

If I saw a doctor, she would stand by me. If I refused, she would go. I will never forget the bliss of standing at the kitchen sink in that horrid farmhouse and realising that I did not mind. Washing this cup, drying that plate was enough. It was - and I am completely serious - heaven.

Contributing something is better than nothing. Refrain from touching this money for any purpose unless the circumstances are dire. This is a huge mistake. Many employers will often match your contributions to a certain percent. If you are not taking advantage of this, you are missing out on free money! Contributing to your k will also reduce your taxable income yay less taxes! This one may be hard if you are swimming in debt. Having an emergency fund is so important if you want to get yourself off the financial merry-go-round of being stuck in the debt cycle. This money is for periodic expenses like medical expenses, auto maintenance and repairs, appliances, birthday gifts, Christmas gifts, and home maintenance costs.

It allows you to pay with cash instead of relying on a credit card for unexpected expenses.

Watching the cash disappear from your wallet can actually teach you a lot about where the money goes each month! Order by newest oldest recommendations. I began working on it before I really invested in FIRE, but I would nominate developing a meditation practice as the single most beneficial tool for avoiding getting mired in the muck. I do detail rather badly. This training can transform your life with these simple 6 steps! Thanks for the post, it reminded me that this is all normal, part of the process and is to be expected.

This fun money is guilt-free money that you can spend on movies, entertainment, eating out, a manicure, junk food or anything else that you wish. There has to be room to have fun to keep yourself motivated for moving ahead with your financial picture. Reduce the number of categories you use.

Many budget software programs instruct you to use a hundred different categories or subcategories. As you can see from my free home budget spreadsheet , I do not advocate that. The simpler the better. Personal Capital also does not set you up with hundreds of confusing categories. If you want to simplify your budget, use as few as you can. Rather than having a category for every entry, combine some expenses into a larger category to keep it simple.

And the reality of life is that when you get rid of one idiot, another will show up to take his place. It's the curse of humanity. I have made my choice.

Testimonials

I choose the roller-coaster. There is more risk when you choose the roller-coaster, but at least you will know you have lived. You have thinking problems.

- Susan Allan.

- Cornsilk Casey!

- Buy for others?

- Vom Referat bis zur Examensarbeit: Naturwissenschaftliche Texte perfekt verfassen und gestalten (Springer-Lehrbuch) (German Edition).

Your priorities are out of whack. Your biggest problem is not in your wallet or your bank account. Your biggest problem is between your ears. You will fix your money problems when you fix your other problems. Live your life the way you want to live it. Don't have the money to do that? Remind yourself that your condition is your own damn fault and then commit and constantly recommit yourself to having the money to live any way you want to live. It is the willingness to do the right thing even when everyone else is doing the wrong thing.

Insanity Quotes

You create your results—no one else. Luckily, the truth doesn't care. Work on yourself, work on your life, and working while you are at work. Get angry and fight back. Yep, I said fight. You are in a battle. You need to steel your confidence with anger.